PRESS RELEASE: Angela Richardson accused of cynical U-turn over Windfall Tax

Guildford Liberal Democrats

Contact: Zöe Franklin or office@guildfordlibdems.org.uk

EMBARGO: Immediate

- Government finally announces a Windfall Tax on oil and gas companies the day after damning report into Prime Minister is published

- Families across Guildford, Cranleigh and our villages £800 worse off due to tax hikes

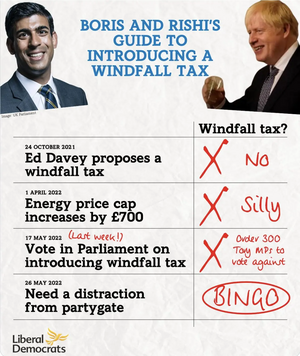

The local Conservative MP has been accused of a "cynical U-turn" after voting against a Windfall Tax last week, despite the Chancellor announcing a new tax today on oil and gas firms.

Last week, 248 MPs voted in favour of a Windfall Tax on the record profits of oil and gas firms. Yet the Conservative MP for Guildford did not show their support for the proposal.

Just a day removed from Sue Gray's damning report into illegal parties at Downing Street, the Conservative Government completed a U-turn on introducing a Windfall tax on oil companies.

The Liberal Democrats were the first party to call for a Windfall Tax on oil and gas companies in October 2021, with the funds raised being used to cut people's energy bills.

New analysis by the Liberal Democrats has also revealed Rishi Sunak's tax hikes have cost the average household £800.

Zöe Franklin, Liberal Democrat parliamentary candidate for Guildford, Cranleigh and our villages said:

"Our Conservative MP has done a cynical U-turn after opposing a Windfall Tax for months. It shouldn't have taken another day of scandal for Boris Johnson for the Government to act on the cost of living.

"The Chancellor's arrogant dismissal of a windfall tax left pensioners across Guildford, Cranleigh and our villages sitting in the cold last winter. Our Conservative MP supported the Chancellor in shamefully opposing measures to cut people's energy bills.

"The announcement in Parliament today is nothing more than a scam. Rishi Sunak's tax hikes will hit families in our area with an £800 bill, more than wiping out any new measures announced.

"We need a new voice in Parliament standing up for families and pensioners in our area. At the next election, it will be a two-horse race between the Liberal Democrats and Boris Johnson's out of touch Conservative Party."

ENDS

NOTES TO EDITORS

On Tuesday 17th May Conservative MPs voted against an amendment to the Queen's Speech which would have introduced a Windfall Tax on oil and gas companies. The amendment read:

"but respectfully regret that the Gracious Speech fails to announce a windfall tax on the profits of oil and gas producers, in order to provide much-needed relief from energy price increases for households."

Rishi Sunak's £20 bn tax bill:

● £13.8 bn in personal tax rises this year - through the National Insurance rise and the freezing of Income Tax thresholds

● £8.6 bn in extra VAT due to inflation this year

There are 28 million households in the country. This means the £22.4 billion amounts to a total tax hike of £800 per household.

According to the latest OBR forecast from March 2022, the Government will raise an additional £13.8 billion from personal taxes in 2022-23. This comprises £2.9bn from the freezing of Income Tax thresholds and £10.9bn from the National Insurance increase. This takes into account the increase in NI thresholds announced at the Spring Statement. (see Table A.5, p.205 - March 2022 EFO).

The additional £8.6bn VAT hit is based on the latest forecasts for VAT receipts from the OBR, compared to its previous forecast published last year. VAT receipts forecasts are taken from the OBR's Economic and fiscal outlooks: March 2021 (Table 3.4 on page 103) and March 2022 (Table 3.4 on page 95). The difference between the March 2021 and March 2022 forecasts amounts to an additional VAT hit of £8.6bn in 2022-23 (Expected receipts of £154.2 bn vs £145.6 bn previously).

Abi Baker